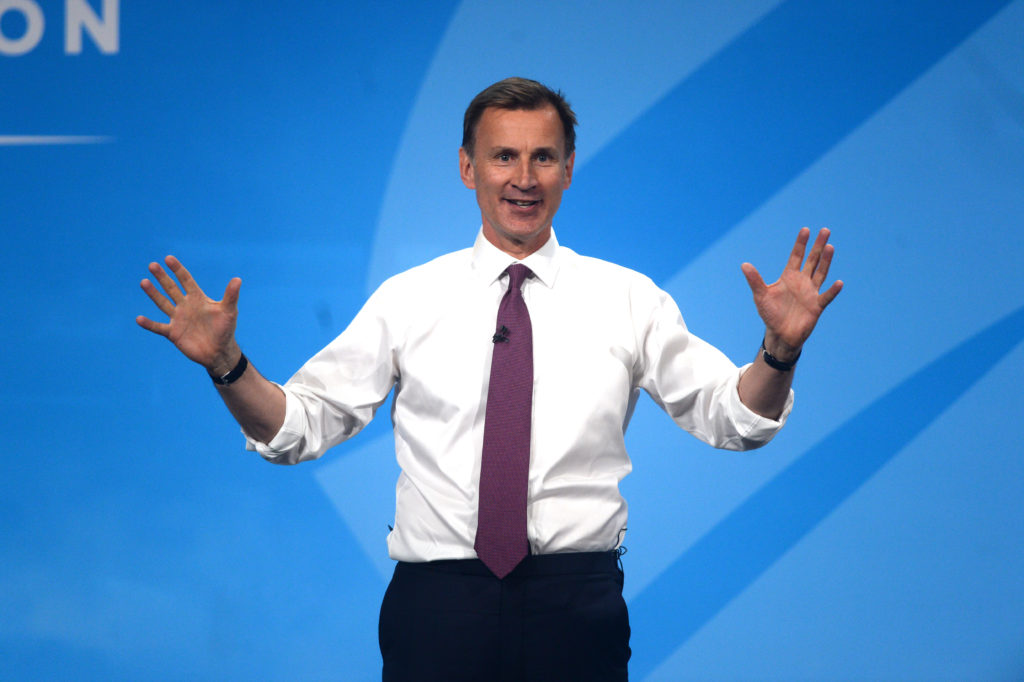

The chancellor Jeremy Hunt has this morning announced that the government’s proposed financial statement for 31 October has been moved back 2 weeks till 17 November.

With the pound recovering in the foreign exchange markets and the cost of long term government gilts falling, the government now has greater breathing space with the financial markets than they did in mid October.

The financial markets have not reacted adversely to this morning’s delay, with the pound actually gaining against the dollar in lunchtime trading. This is something that would have been highly unlikely two weeks ago, suggesting that the financial markets are reassured by the noises on tax and spending that they are now hearing from the new government.

The two and a half week delay will give the chancellor and the prime minister greater time to perfect the measures that they will need to include in the statement as they look to close an annual deficit in the government finances in the region of £35 billion.

With the wholesale price of energy declining, and the medium term cost of government borrowing also falling, the government will no doubt hope that the fiscal challenge will have reduced further by mid November.

The delay will also avoid the financial statement being held on Halloween, the traditional day of horrors, something that would not necessarily have worked well in terms of optics for the Conservative party.

Speaking to journalists at Westminster this lunchtime, the prime minister’s spokesperson reiterated that the government remained committed to the promise of its 2019 general election manifesto, but wouldn’t be drawn on the extent to which this related to every policy measure within it.

Alongside core decisions around taxation, notably with corporation tax, the government is facing a number of tough spending decisions. These include whether to up-rate universal credit in line with inflation, whether to continue with the current capital hospital building programme, whether to spend 0.7% of GDP on international trade, and whether to maintain the so called triple lock through which the state pension rises with inflation.

The government’s financial statement will now occur after the Bank of England’s next monetary policy committee meeting on November 3. The delay means that the Bank will need to set interest rates next week without knowing the knowing the government’s plans for tax and spending.