Blair sidesteps house price warning

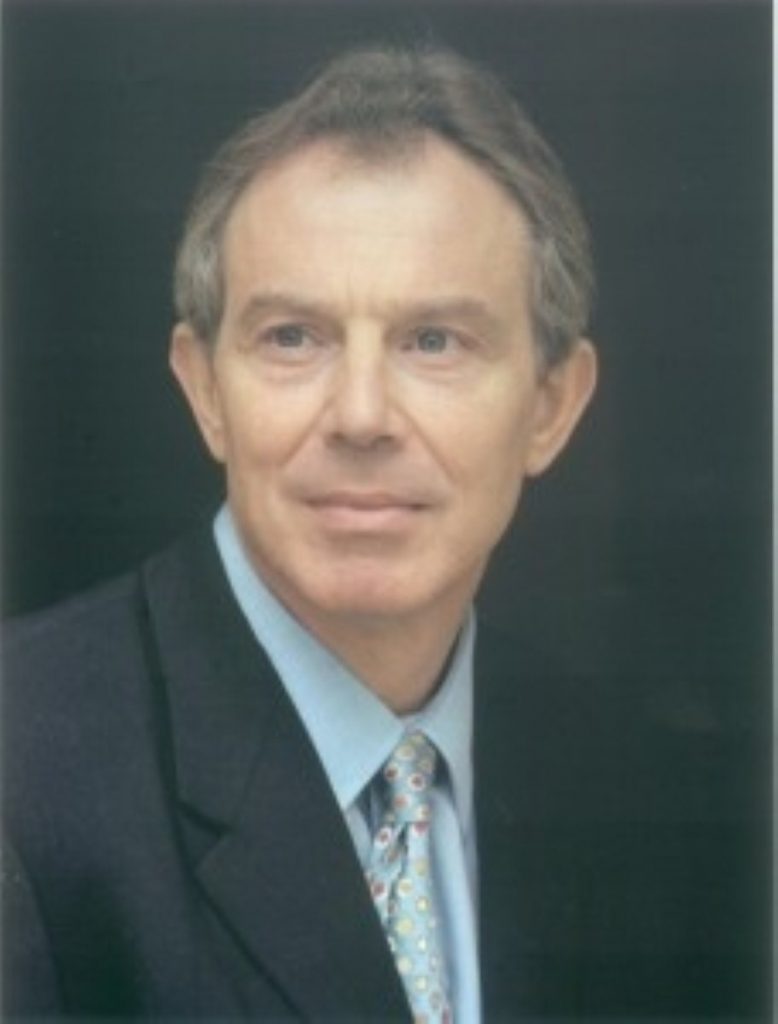

Tony Blair has attempted to sidestep questions on the state of the housing market.

Last night the Governor of the Bank of England told a dinner in Glasgow that he was concerned by the potential negative effects of spiralling house prices on the economy.

Mervyn King noted that house prices have more than doubled over the past five years, and said: “This sustained increase has repeatedly confounded expectations and taken the ratio of house prices to earnings to record levels.

“Demographic factors, a shortage of housing supply and low levels of inflation and interest rates, all mean that the sustainable ratio has probably risen somewhat over the past decade. Nevertheless, it is now at levels which are well above what most people would regard as sustainable in the longer term.

“After the hectic pace of price rises over the past year it is clear that the chances of falls in house prices are greater than they were. So anyone entering or moving within the housing market should consider carefully the possible future paths of both house prices and interest rates.”

Mr King said there is no “pre determined plan” on high interest rates will rise, but reiterated the prime motivation of the rises is to “keep inflation on track to meet our 2 per cent target for CPI inflation in the medium term”

Mr King’s comments have raised fears about a possible housing market crash similar to that witnessed in the early 1990s.

Speaking at his monthly press conference, in comments broadcast on BBC News 24 this lunchtime, the PM insisted that it was not for him to provide a running commentary on the announcements of the BoE.

“We have introduced a system where the Bank of England is responsible for setting monetary policy and interest rates. I think we are best to let them to do that obviously, and I don’t think there is any point in me being a pundit for what the governor has said.”

‘He has said what he has said, for the reasons that he has given, and I think that those words stand on their own.’

The Bank of England was “simply setting out its position”, Mr Blair remarked.

“That is fine – that is their job to set it out. Our job is to try and make sure that we have in place the right framework of economic policy to keep the stability that has been so hard won and so good for the country.”

“Let’s not forget that our economy has probably been the most successfully performing economy of any of the major economy in the past couple of years.

“It is true that interest rates have gone up just recently by a quarter per cent following another quarter per cent rise, but let’s not forget where we were 10 or 15 years ago when interest rates were 10 per cent and we had negative equity and all the rest of it.”

Interest rates have risen for two consecutive months to 4.5 per cent after maintaining a low of 3.5 per cent for much of last year.